Budget 2016: Live India Union Budget 2016-2017 Highlights Main Points Details

- Details

- Category: National Political News

- Last Updated: Monday, 29 February 2016 19:07

Budget 2016: Live India Union Budget 2016-2017 Highlights Main Points Details, Budget 2016, India Union Budget 2016, Union Budget 2016-2017 highlights, Budget Main Points Details, Union Budget Details, Indian Budget 2016, third Budget Arun Jaitley, Key Budget Offerings, Budget for Common People, BUdget highlights

This is third Union Budget By NDA government for the financial year 2016 - 2017.

Budget Highlights 2016 - 2017

- Rs. 1,060 crore revenue loss through direct tax proposals, and Rs. 20,670 crore revenue gain through indirect tax proposals. Revenue gain of Rs 19,600 crore in Union Budget 2016 proposals.

- No Service Tax for houses built under 60 square metres.

- 1 per cent service charge on purchase of luxury cars over Rs. 10 lakh and in-cash purchase of goods and services over Rs. 2 lakh.

- Additional exemption of Rs. 50,000 for housing loans up to Rs. 35 lakh, provided cost of house is not above Rs. 50 lakh. No changes have been made to existing income tax slabs.

- 40% of withdrawal at the time of retirement under National Pension Scheme to be tax exempt.

- People with income less than Rs 5 lakh to get deduction of Rs 5,000, up from Rs 2,000 last year.

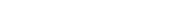

- Subsidy to take LPG to BPL families. Excellent for clean air

- HRA deduction increased to Rs 60,000p.a

- Rs 2,21,246 crore for infrastructure.

- Total outlay on roads and rails will be Rs. 2.80 lakh crore. Rs. 97,000 crore for all roads.

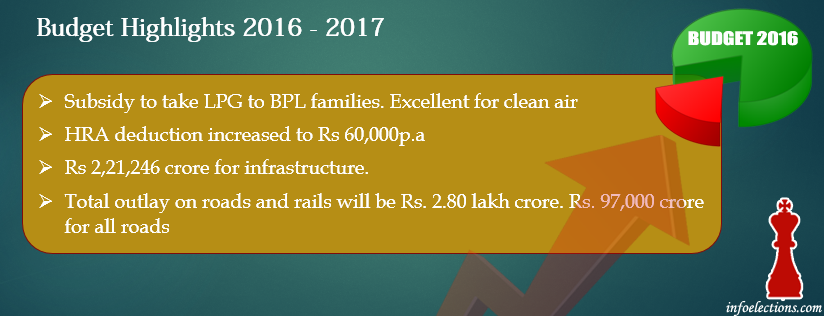

- Rs 3,000 crore - for nuclear power. Rs. 25,000 crore for recapitalisation of public sector banks

- Small shops should be given the choice to remain open on all 7 days a week.

- Total rural sector allocation Rs. 87,769 crore. 1,700 crore for 1500 multi-skill development centres.

- Rs. 9,000 crore for Swachch Bharat Abhiyan.

- Rs. 38,500 crore for MNREGA. Highest ever for the rural employment scheme.

- Agricultural credit target of Rs. 9 lakh crore. Rs 5,500 crore for crop insurance scheme.

Here are the live updates:

11:53 a.m.: 100% FDI through FAPB route in marketing of food products produced and manufactured in India.

11.47 a.m.: In the power sector, the govt is drawing up a plan for 15-20 years to augment investment in nuclear power. Rs. 3,000 crore per annum for this.

11.45 a.m.: There are 160 airports and airstrips which can be revived.

11.44 a.m.: Motor Vehicles Act to be amended to enable entrepreneurship in the road transport sector.

11.43 a.m.: Total outlay for infrastructure is at Rs. 2.31 lakh crore.

11.42 a.m.: Rs. 97,000 crore for all roads. Total outlay on roads and rails will be Rs. 2.80 lakh crore. 10,000 km of national highways in 2016-17 and 50,000 km state highways to be converted to NH roads.

11.41 a.m.: More than 70,000 road projects were languishing at the beginning of the year. Nearly 85% of these projects have been put back on track.

12.22 p.m.: Additional exemption of Rs. 50,000 for housing loans up to Rs. 35 lakh, provided cost of house is not above Rs. 50 lakh.

12.20 p.m.: 40% of withdrawal at the time of retirement under National Pension Scheme to be tax exempt.

12.19 p.m.: Tax holiday for startups for three of five years of setting up the company

12.13 p.m.: Lowering of Corporate IT rate for companies not exceeding Rs. 5 crore turnover to 25% plus surcharge.

12.09 p.m.: Ceiling under 87A to be increased by Rs. 3,000. HRA deduction up from Rs. 24,000 to Rs. 60,000 p.a.

12.08 p.m.: Rs. 100 crore for Deendayal Upadhyay's birthday celebrations and Guru Gobind Singh 300th birth anniversary.

12.07 p.m.: Classification of expenditure as plan and non-plan to be done away with.

12.06 p.m.: FIscal deficit at 3.5% of GDP in 2016-17.

12.04 p.m.: A bill on targeted delivery of financial services using Aadhar to be introduced.

12.03 p.m.: Amendment to the Companies Act to ensure speedy registration and boost start-ups.

12.02 p.m.: Rs. 900 crore for buffer stock of pulses.

12.01 p.m.: Dept of Disinvestment renamed as Dept of Investment and Public Asset Management.

12 noon: Direct Benefit Transfer for fertiliser subsidy.

11.59 a.m.: EPF at 8.33 per cent for new employees joining the scheme.

11.58 a.m.: Rs. 25,000 crore for recapitalisation of public sector banks. General insurance companies owned by the govt to be listed in stock exchanges.

11.39 a.m.: Small shops should be given the choice to remain open on all 7 days a week.

11.37 a.m.: Rs. 1,700 crore for 1500 multi-skill development centres.

11.35 a.m.: 10 public and 10 private educational institutions to be made world-class. Digital repository for all school leaving certificates and diplomas. Rs. 1,000 crore for higher education financing.

11.34 a.m.: Hub to support SC/ST entrpreneurs.

11.33 a.m.: National dialysis service programme under PPP model. LPG connection for women members of rural homes.

11.30 a.m.: Government to provide health insurance of upto Rs. 1 lakh per family. 3,000 stores to be opened for generic drugs.

11.30 a.m.: Total rural sector allocation Rs. 87,769 crore.

11.27 a.m.: Two schemes for digital literacy for rural India to cover 6 crore households in the next three years.

11.26 a.m.: Rs. 9,000 crore for Swachch Bharat Abhiyan.

11.25 a.m.: 5,542 villages have been electrified, more than the last three years combined.

11.24 a.m.: Rs. 38,500 crore for MNREGA. Highest ever for the rural employment scheme.

11.23 a.m.: Rs. 2.87 lakh crore for gram panchayats as per recommendation of 14th finance commission.

11.22 a.m.: Four schemes for animal welfare.

11.19 a.m.: Agricultural credit target of Rs. 9 lakh crore. Govt to allocate Rs 5,500 crore for crop insurance scheme.

11.19 a.m.: Unified e-platform for farmers to be inaugurated on Ambedkar's birthday.

11.17 a.m.: Paramparagat Krishi Vikas Yojana to bring 5 lakh acres under organic farming.

11.14 a.m.: 28.5 lakh hectares to be brought under irrigation.

11.13 a.m.: Govt will reorganise agricultural policy to double farmer income in five years.

11.11 a.m.: Jaitley announces the nine pillars of his Budget — Agriculture and farmers' welfare, rural sector, social sector including healthcare, education, skills and job creation, infrastructure, financial sector reforms, ease of doing business, fiscal discipline, tax reforms to reduce compliance burden.

11.11 a.m.: New scheme for BPL families for gas connections. Staturtory backing for Aadhaar platform to ensure delivery of benefits.

11.10 a.m.: CAD is 1.4% of GDP.

11.10 a.m.: FY 16-17 will have the additional burden of implementing the VII pay commission and the defence OROP.

11.08 a.m.: FY 15-16 and 16-17 will be challenging for the government.

11.07 a.m.: Forex reserves are at the highest ever levels — $350 billion.

11.05 a.m.: GDP growth has accelerated to 7.6%. CPI inflation has come down to 5.4%.

11.05 a.m.: Mr. Jaitley says the Indian economy has held strong despite a global slowdown.

11 a.m.: Arun Jaitley rises to present the Budget.

10:46 am: Mr. Jaitley's Budget speech to begin in 15 minutes.

10:43 am: Union Cabinet clears General Budget for 2016-17.

10:29 am: Cabinet meeting in Parliament ends.

10:05 am: The Sensex falls 59 points in early trade on reduced bets by cautious retail investors amid continued capital outflows by foreign funds ahead of the Budget. More...

9:53 am: Pre-Budget Cabinet meet to begin shortly.

9:40 am: Mr. Jaitley, MoS Jayant Sinha arrive in Parliament.

What People are expecting from the budget 2016 - 2017

- MFs expect basic income tax exemption going up to Rs 3 lakh

- Stock market looks up to Union Budget for cues

- Budget may address retrospective tax concerns

- Budget 2016: Start-ups bat for tax sops, investment incentives

- Don't reimpose customs duty on crude: Oil firms

- Budget 2016: Tweak policy to boost electronics industry growth

source: thehindu.com